The Complex World of Cryptocurrency: Understanding Crypto, Systemic Risk, Market Makers, and Forks

Cryptocurrencies have revolutionized the way we think about money and financial transactions. But beneath the surface of these digital currencies lies a complex web of risks, market dynamics, and innovative business models that can make or break an investment.

What is Cryptocurrency?

A cryptocurrency is a digital or virtual currency that uses cryptography for security and is decentralized, meaning it’s not controlled by any government or financial institution. The most well-known cryptocurrencies are Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC). These currencies operate on a peer-to-peer network, allowing users to send and receive funds without the need for intermediaries like banks.

Systemic Risk: A Growing Concern

Systemic risk refers to the potential for a global economic crisis or financial instability that affects the entire financial system. Cryptocurrencies are considered high-risk assets because their value can fluctuate wildly, and their lack of regulation makes them vulnerable to manipulation by market participants with ill intentions. When cryptocurrencies like Bitcoin surged in value during 2017-2018, they attracted large amounts of investment from unsuspecting investors, creating a perfect storm of volatility.

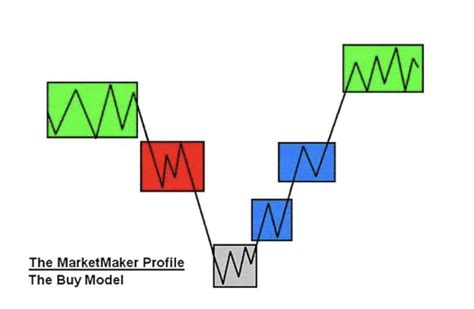

Market Makers: The Unsung Heroes

A market maker is an entity that buys and sells securities on behalf of other market participants to maintain fair prices for the markets. In the cryptocurrency space, market makers play a crucial role in supporting price discovery and facilitating transactions between buyers and sellers. Market makers are essentially “liquidity providers” who ensure that the markets remain liquid and efficient.

For example, when you buy Bitcoin (BTC) on an online exchange, there’s usually another party on the other side of the trade acting as a market maker. These market makers provide liquidity to the market by buying and selling securities at prevailing prices, helping to maintain fair market conditions.

Forks: A Revolutionary Breakthrough

In 2017, Bitcoin was forked into two separate branches: the “main” branch (BTC) and the “shard” branch (BSV). The main branch retained its original code and functionality, while the shard branch introduced a new consensus algorithm called the Proof-of-Stake (PoS) protocol. This change allowed for faster transaction processing times and reduced energy consumption.

The fork was designed to improve the scalability and security of Bitcoin, making it more attractive to users who were tired of waiting for long periods of time to confirm transactions. The shard branch was also seen as a way to decentralize the network further, allowing individual nodes on the blockchain to act independently and maintain their own copies of the blockchain.

The Fork: A Controversial Decision

The fork was met with widespread criticism from developers who believed that it compromised Bitcoin’s core principles and created unnecessary complexity. The decision to introduce a new consensus algorithm, while intended to improve scalability, ultimately led to a split in the community.

In 2020, the original creator of Bitcoin, Satoshi Nakamoto, announced that he would be shutting down his development work on Bitcoin Core, citing the ongoing controversy surrounding the fork. This marked the end of an era for Bitcoin and introduced a new chapter in its history.

Conclusion

Cryptocurrencies are a rapidly evolving field with inherent risks and opportunities. Market makers play a vital role in supporting price discovery and facilitating transactions in the cryptocurrency space. While forks have been used to introduce innovative features like PoS protocols, they also introduce complexity and controversy into the ecosystem.