“Cryptocurrency liquidity crisis crisis: altcoin and risk search”

The world of cryptocurrencies was recently on a roller ride and the prices are wildly floating between bull markets and bear. One of the most important concerns is the lack of liquidity in the market, which can cause significant losses for both operators and investors.

altcoin liquidity crisis

One of the main causes of the liquidity crisis is the domain of a little Altcoin, such as Bitcoin (BTC) and Ethereum (ETH). These coins have attracted large quantities of purchase and sale orders, making it difficult for smaller players to participate in the market. Consequently, prices can become highly volatile, leading to a significant drop in prices and benefits.

For example, on December 29, 2021, the Bitcoin price fell from $ 64,804.03 to $ 17,343.45 with a loss of more than 68%. This event underlined the risks associated with the purchase of Altcoin without adequate research or diversification.

Pool risks

Another problem is the risk of swimming pools that have become increasingly popular lately. The pitches allows users to earn a reward in possession of a certain amount of coins for a limited time rather than selling them at a certain price. However, it also means that users are linked to coins for a long time, leaving them vulnerable to market fluctuations.

One of the major risks associated with pools is the “block” effect in which users cannot access their coins until the stands are over. This means that if prices decrease significantly after the initial locking period, users can be blocked with a large amount of coins that cannot sell or transfer.

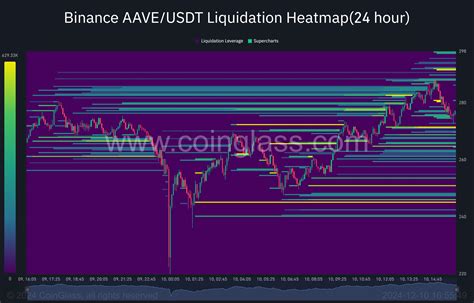

Risks of liquidation

The elimination refers to the process of selling activities with a loss to prevent further losses. In the context of the cryptocurrency, the liquidation can occur if the tribune pool fails or is unable to cover its off -suspended debts. This can cause significant losses for users who have invested in the coin in the pool.

For example, if the impact pool has failed and is unable to pay the reward, it could be forced to sell its coins at a low price. If this happens too quickly, the buyer can be blocked with a large or constant large amount of token.

Risks of Altcoin

In addition to the risks associated with pools, there is also a significant risk associated with the purchase of Altcoin without adequate research or diversification. Altcoin are often high prices and can be very speculative, causing significant losses to traders who invest too much on the market.

For example, on January 3, 2022, Dogecoin (Doge) dropped from $ 0.06 to 0.00004 USD, loss of more than 96%. This event underlined the risks associated with investments in Altcoin without adequate research or diversification.

Conclusion

In conclusion, cryptographic markets are facing significant risks of liquidity and pools, which may have devastating consequences for users who invest in these markets. It is important to focus on these markets before making any investment decision and carefully conducting accurate research.

Understanding the risks associated with Altcoin, stamp pools and other cryptocurrency markets, traders and investors can make decisions deliberate on their investments and reduce exposure to risk.